child tax credit november 2021 payments

The latest round of monthly child tax credit payments is scheduled to be distributed to tens of millions of families on Monday. Child tax credit 2022 are ctc payments really over marca what s the.

Child Tax Credit Delayed How To Track Your November Payment Marca

Those payments will last through December.

. During the week of September 13-17 the IRS successfully delivered a third monthly round. The IRS is paying 3600 total per child to parents of children up to five years of age. To reconcile advance payments on your 2021 return.

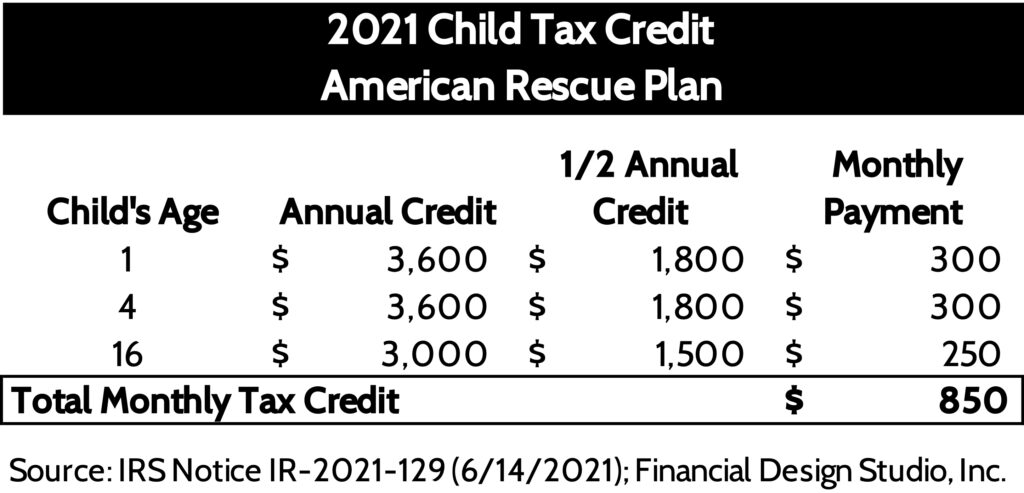

The IRS has made a one-time payment of 500 for dependents age 18 or full-time college students up through. The advanced Child Tax Credit payments are due out on the 15th day of each month over the second half of 2021 meaning that November 15. Thats 300 per month 3600 12 for the younger child and 250 per month 3000 12 for the older child.

Here are more details on the November payments. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids who are. The fully refundable tax credit which is usually up to 2000.

That drops to 3000 for each child ages six through 17. The last payment for 2021 is scheduled for Dec. See irs schedule 8812 form 1040.

For these families each payment is up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6 through 17. Thats an increase from the regular child tax credit of up. The enhanced child tax credit is in effect only for 2021.

657K Likes 21K Comments. Enter your information on Schedule 8812 Form 1040. Here are more details on the November payments.

Childtaxcredit Some may have recevied an INCORRECT version of Letter 6419. Get your advance payments total and number of qualifying children in your online account. Determine if you are eligible and how to get paid.

Of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax Credit. 15 will receive a lump-sum payment on Dec. Thats an increase from the regular child tax credit of up.

For these families each payment is up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6 through 17. The advance is 50 of your child tax credit with the rest claimed on next years return. 15 when the final advance CTC payment rolls.

New Study Highlights The Cost. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 through 17 for 2021. 12 2021 Published 1036 am.

The couple would then receive the 3300. Families will see the direct deposit payments in their accounts starting November 15. The Child Tax Credit provides monthly payments to families even those who do not file taxes or earn an income.

The Treasury Department said families with roughly 61 million eligible children received more than 15 billion in the fifth batch of Advance Child Tax Credit payments most via direct deposit. The fourth monthly payment of the expanded Child Tax Credit kept 36 million children from poverty in October 2021. IMPORTANT Monthly Child Tax Credit IRS UPDATE 12822 IRS sent you Letter 6419 ONLY IF you received the.

Half of the total is being paid as six monthly payments and half as a 2021 tax credit. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 through 17 for 2021. So parents of a child under six receive 300 per month and parents of a child six or over receive 250 per month.

ET In 2021 more than 36 million American families may be eligible to receive a child tax credit. IRS Updates 2021 Child Tax Credit Frequently Asked Questions Those who opt in on or before Nov. The last payment for 2021 is scheduled for December 15.

TikTok video from The News Girl lisaremillard. Families will see the direct deposit payments in their accounts starting Nov. How to calculate your CTC balance on 2021 tax return.

3600 for children ages 5 and under at the end of 2021. Half of the total is being paid as six monthly payments and half as a 2021 tax credit. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

Child Tax Credit 2021 Update November Stimulus Check Payment Date Is Next Week Ahead Of Final 300 Deadline

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Child Tax Credit Delayed How To Track Your November Payment Marca

2021 Advanced Child Tax Credit What It Means For Your Family

European Flag European Commission Brussels 4 2 2022 Swd 2022 24 Final Commission Staff Working Document Cohesion In Europe Towards 2050 Accompanying The Document Communication From The Commission To The

Child Tax Credit Update Next Payment Coming On November 15 Marca

Irs Gives Taxpayers One Day To Rightsize Child Tax Credit November Payments November 1

Did Your Advance Child Tax Credit Payment End Or Change Tas

The Final Child Tax Credit Payment Of 2021 Is Here Is It The Last One Ever Here S What Happens Next Marketwatch

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

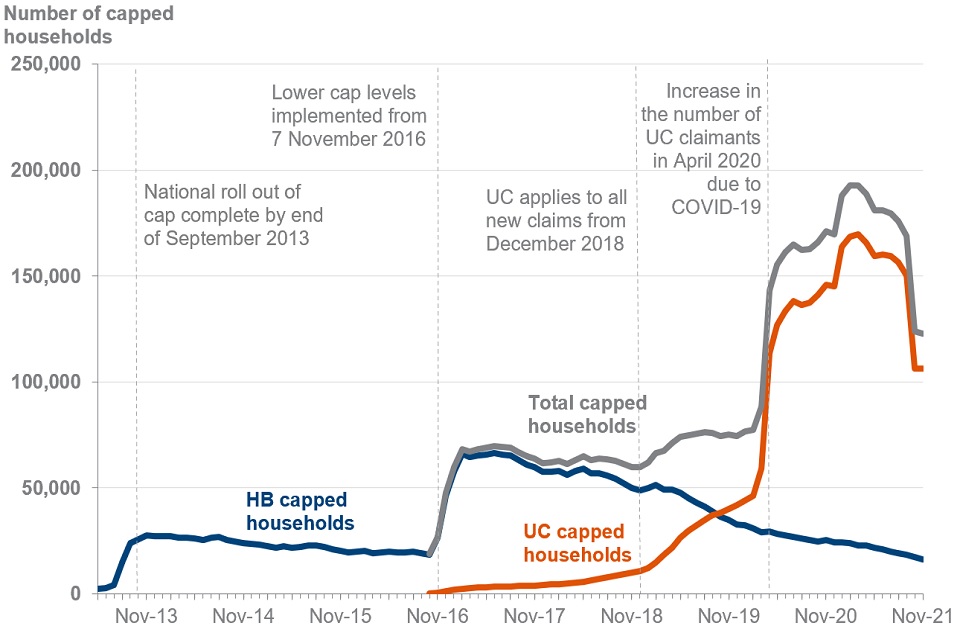

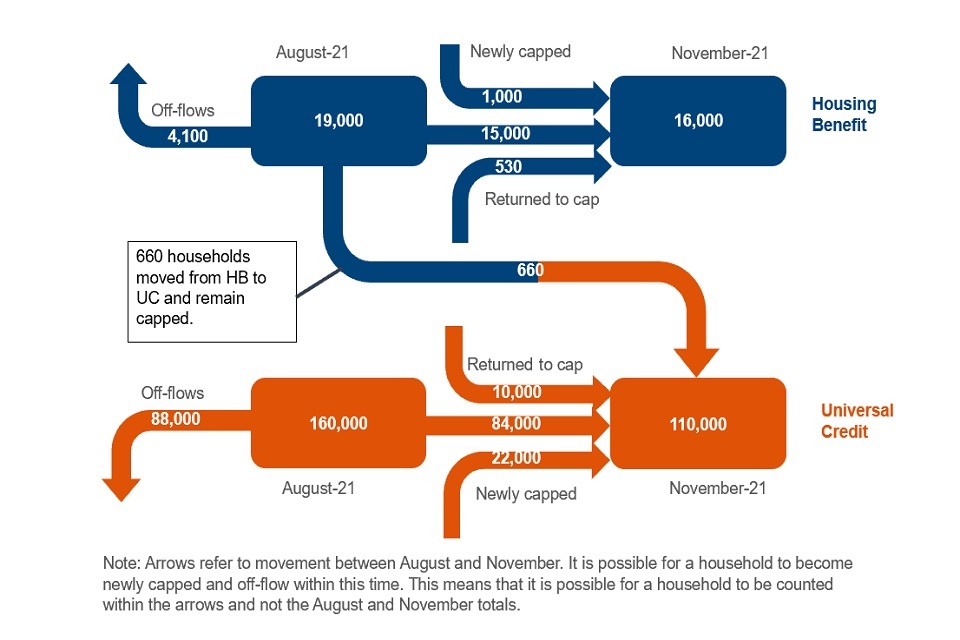

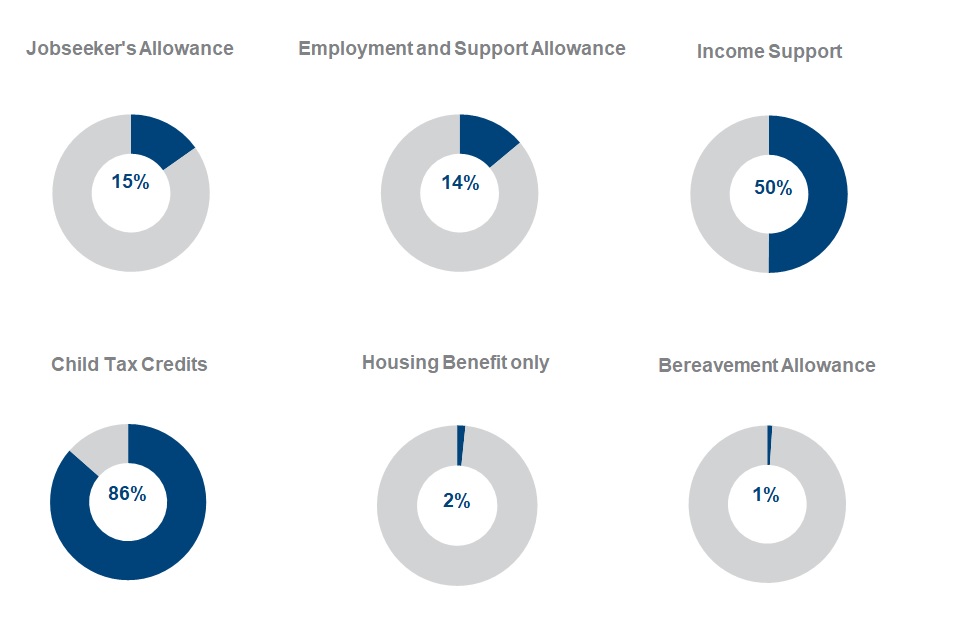

Benefit Cap Number Of Households Capped To November 2021 Gov Uk

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Ca Inter Ipcc Amendments For May Nov 2021 Exams Summarized Manner

Benefit Cap Number Of Households Capped To November 2021 Gov Uk

Benefit Cap Number Of Households Capped To November 2021 Gov Uk